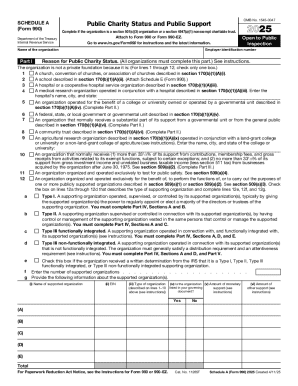

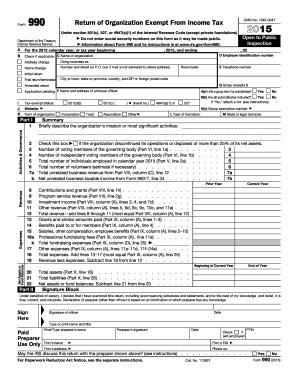

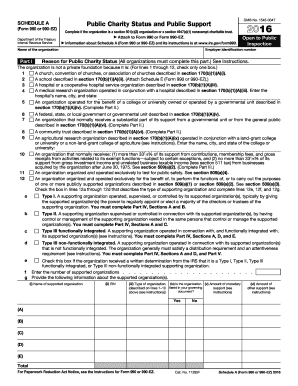

IRS 990 - Schedule A 2015 free printable template

Instructions and Help about IRS 990 - Schedule A

How to edit IRS 990 - Schedule A

How to fill out IRS 990 - Schedule A

About IRS 990 - Schedule A 2015 previous version

What is IRS 990 - Schedule A?

Who needs the form?

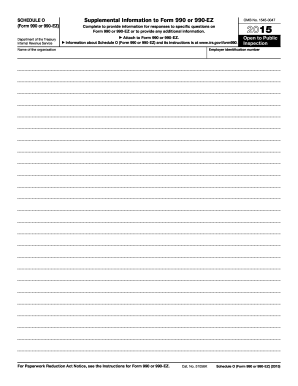

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule A

What should I do if I realize I've made a mistake after submitting the 2015 IRS 990 form?

If you discover a mistake after filing your 2015 IRS 990 form, you can submit an amended form to correct the errors. Ensure that you clearly indicate that it's an amended return and include any necessary explanations of the changes made to avoid confusion with the IRS.

How can I verify if my 2015 IRS 990 form has been received and processed?

To verify receipt and processing of your 2015 IRS 990 form, you can contact the IRS directly or utilize online tools provided by the IRS for tracking submissions. Be prepared with any relevant details like your organization's name and Employer Identification Number (EIN) to facilitate the process.

What are common errors that lead to the rejection of the 2015 IRS 990 form during e-filing?

Common errors that can lead to rejection of the 2015 IRS 990 form include incorrect formatting of fields, missing required information, and failing to match data across forms. Carefully reviewing your entries against the expected criteria can help minimize these issues before submission.

What should I do if I receive a notice from the IRS regarding my 2015 IRS 990 form submission?

If you receive a notice from the IRS concerning your 2015 IRS 990 form, first read it thoroughly to understand the issue raised. Prepare any necessary documentation to respond effectively and follow the outlined instructions carefully to resolve the matter promptly.

Are there specific technical requirements for e-filing the 2015 IRS 990 form?

Yes, there are specific technical requirements for e-filing the 2015 IRS 990 form, which include compatibility with certain browsers and software, as well as adherence to file size limits and formatting guidelines. Ensuring you meet these technical prerequisites is crucial for a successful e-filing experience.

See what our users say